In the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone indicator, providing valuable insights into price momentum and potential market reversals. However, traditional RSI calculations often produce delayed signals, limiting their effectiveness in fast-paced markets. To address this limitation, MT4 Improved RSI Indicator emerges as a refined tool, offering enhanced market insights and enabling traders to navigate price momentum with greater precision. In this comprehensive guide, we delve into the functionalities of MT4 Improved RSI and explore strategies for unlocking its potential.

Understanding the Foundations of Relative Strength Index:

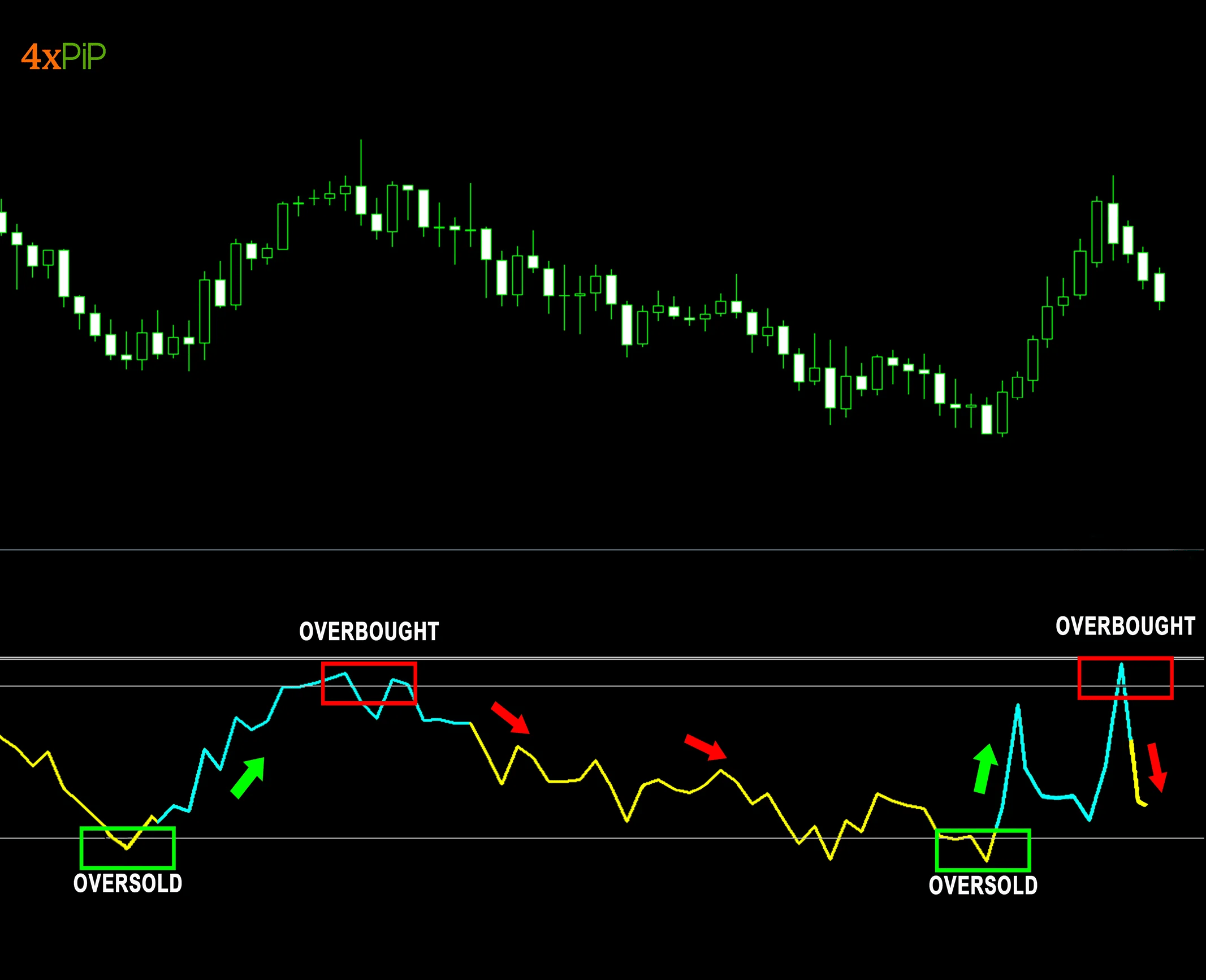

RSI, a momentum oscillator, measures the magnitude of recent price changes to assess overbought or oversold conditions in a market. It oscillates between 0 and 100, with readings above 70 typically indicating overbought conditions and readings below 30 suggesting oversold conditions. The introduction of the MT4 Improved RSI (Relative Strength Index) Indicator, with its advanced calculations and refined features, enhances the use of RSI for trading signals. Here’s a breakdown of the key points when introducing this indicator:

Modified RSI Formula:

Here’s an explanation of the specific changes in the formula and how it incorporates a smoothing factor to reduce the impact of outliers:

Traditional RSI Formula: The traditional RSI is calculated based on two main components: the average gain and the average loss over a specified period. It’s expressed as a value between 0 and 100.

- Calculate the average gain and average loss over the selected period. These are typically based on closing prices.

- Average Gain = (Sum of gains over ‘N’ periods) / ‘N’

- Average Loss = (Sum of losses over ‘N’ periods) / ‘N’

- Calculate the Relative Strength (RS) by dividing the Average Gain by the Average Loss:

- RS = Average Gain / Average Loss

- Finally, calculate the RSI using the RS value:

- RSI = 100 – (100 / (1 + RS))

Modified RSI Formula (MT4 Improved RSI): The MT4 Improved RSI introduces a modification to the traditional RSI formula by incorporating a smoothing factor. This smoothing factor helps to reduce the impact of outliers, making the indicator less sensitive to extreme price movements.

- Calculate the average gain and average loss over the selected period, just as in the traditional RSI.

- Calculate the Relative Strength (RS) by dividing the Average Gain by the Average Loss, as in the traditional RSI.

- Apply the smoothing factor to the RS value. The smoothing factor is often a constant, and it helps to create a smoother RSI curve. This can be particularly useful in reducing the noise in the RSI readings.

- Smoothed RS = (1 – Smoothing Factor) * Previous Smoothed RS + Smoothing Factor * Current RS

- Finally, calculate the Improved RSI using the smoothed RS value:

- Improved RSI = 100 – (100 / (1 + Smoothed RS))

Impact of the Smoothing Factor: The smoothing factor used in the Modified RSI Formula plays a key role in reducing the sensitivity of the RSI to erratic or outlier price movements. It allows for a more stable and less volatile RSI curve. Traders often find that this modification results in signals that are smoother and potentially more reliable, especially in markets with high volatility.

Benefits for Traders:

Emphasizing the benefits of using the MT4 RSI Indicator is important as it can help traders understand how this modification can enhance their trading strategies. Here are the key advantages of using the MT4 Improved RSI:

- Improved Signal Accuracy:

- The smoothing factor in the Modified RSI Formula reduces the sensitivity to erratic price movements and market noise. This results in improved signal accuracy. Traders can have more confidence that RSI signals reflect genuine changes in market momentum rather than being influenced by outliers.

- Reduced Noise in RSI Readings:

- Traditional RSI readings can be prone to fluctuations and false signals, especially in volatile markets. The Modified RSI Formula minimizes these fluctuations, resulting in RSI readings that are smoother and less noisy. This reduction in noise helps traders focus on more reliable signals.

- Enhanced Trend Identification:

- The MT4 Improved RSI can be particularly useful in identifying and confirming trends. Its reduced sensitivity to outliers helps traders better differentiate between genuine trend changes and short-term price fluctuations.

- Timely Trading Decisions:

- Traders can make more timely trading decisions with the MT4 Improved RSI. Smoother readings and enhanced accuracy mean that signals are generated more consistently and closer to the actual points where momentum shifts occur.

- More Reliable Divergence Signals:

- Divergences, where the RSI moves in the opposite direction of price, can signal potential trend reversals. The Modified RSI Formula can provide more reliable divergence signals by reducing false positives.

- Confidence in Strategy Execution:

- The enhanced accuracy and reduced noise in the MT4 Improved RSI can instill confidence in traders when executing their trading strategies. Knowing that the RSI signals are more reliable can lead to more disciplined and well-informed trading decisions.

- Effective Risk Management:

- With more reliable RSI signals, traders can implement risk management strategies more effectively. They can set stop-loss and take-profit levels with greater confidence, helping protect their capital in the event of adverse market moves.

- Adaptability to Varying Market Conditions:

- The MT4 Improved RSI is versatile and suitable for different market conditions, making it a valuable tool for traders who encounter various trading environments, from trending to ranging markets.

- User-Friendly Integration:

- The MT4 Improved RSI is designed for use within the MetaTrader 4 platform, which is widely adopted by traders. Its seamless integration and familiarity with the platform make it user-friendly for both novice and experienced traders.

The MT4 Improved RSI provides traders with several advantages, including more accurate and less noisy signals, improved trend identification, and enhanced confidence in strategy execution. These benefits can contribute to more successful and disciplined trading strategies, ultimately helping traders achieve their financial goals in the markets.

How to Use MT4 Improved RSI:

ere’s a brief overview of how traders can use the MT4 Improved RSI in their trading strategies, highlighting its applicability for both trend-following and trend-reversal approaches:

1. Identifying Overbought and Oversold Conditions:

- The MT4 Improved RSI can be used to identify overbought and oversold conditions. When the RSI value is above 70, it suggests overbought conditions, indicating a potential selling opportunity. Conversely, when the RSI falls below 30, it indicates oversold conditions, signaling a potential buying opportunity.

2. Trend-Following Strategies:

- Traders can apply the MT4 Improved RSI in trend-following strategies. In a strong uptrend, they may look for opportunities to enter long positions when the RSI pulls back from overbought conditions (below 70) and then rises again, indicating that the trend remains intact. In downtrends, they can consider short positions when the RSI rebounds from oversold conditions (above 30) and starts to decline.

3. Trend-Reversal Strategies:

- The MT4 Improved RSI can also be used in trend-reversal strategies. When the RSI shows a divergence from price action, such as a bullish divergence (RSI moves upward while prices continue to fall) or a bearish divergence (RSI moves downward while prices are rising), it can signal potential trend reversals. Traders can look for confirmatory price action and other technical indicators to make their trading decisions.

4. Confirmation with Other Technical Indicators:

- To enhance the reliability of the MT4 Improved RSI signals, traders often use it in conjunction with other technical indicators, such as moving averages, support and resistance levels, or trendlines. For instance, if the RSI suggests a potential buying opportunity (e.g., in oversold conditions), traders may seek confirmation from a bullish candlestick pattern or a bounce from a key support level.

5. Risk Management:

- Implementing proper risk management is essential when using the MT4 Improved RSI. Traders should set stop-loss and take-profit levels to manage potential losses and profits. The RSI signals should be part of a comprehensive risk management strategy.

6. Timeframes and Market Conditions:

- Traders can adjust the timeframe they use for the MT4 Improved RSI based on their trading goals. It’s versatile and can be applied to various timeframes, from short-term to long-term. Additionally, its adaptability allows it to be used in different market conditions, including trending or ranging markets.

7. Backtesting and Optimization:

- Traders are encouraged to backtest their strategies using historical data to assess the performance of the MT4 Improved RSI. This process can help refine entry and exit rules and optimize the use of the indicator.

Remember that no indicator, including the MT4 Improved RSI, is foolproof, and trading carries inherent risks. Traders should use it as part of a broader trading strategy and continually adapt to changing market conditions. It’s important to practice in a demo account before applying it in live trading to gain experience and confidence.

4xPip, a leading provider of trading tools and resources, offers a comprehensive suite of advanced technical analysis tools, including MT4 Improved RSI Indicator, alongside a wide range of other indicators, expert advisors, and trading strategies. These tools can be seamlessly integrated into trading plans, empowering traders to identify and capitalize on profitable trading opportunities.

Conclusion:

MT4 Improved RSI Indicator revolutionizes RSI analysis by providing enhanced market insights and enabling traders to navigate price momentum with greater precision. By understanding its functionalities and integrating it into trading strategies, traders can unlock the full potential of RSI and enhance their trading performance. Whether you’re a beginner or an experienced trader, the MT4 Improved RSI Indicator is essential to your trading toolkit. Don’t miss out on the opportunity to take your trading to the next level with this powerful indicator.